User:Paul Schächterle/Notebook/LDR: Difference between revisions

imported>Paul Schächterle |

imported>Paul Schächterle |

||

| Line 61: | Line 61: | ||

==Combining both concepts== | ==Combining both concepts== | ||

Neoclassical theory normally distinguishes only | [[Image:Cobb-Douglas with dimishing returns to scale.png|right|thumb|300px|Cobb-Douglas production function with 2 factors and production elasticity complying to the neoclassical LDR, i.e. overall decreasing returns to scale.]] | ||

Neoclassical theory normally distinguishes between only two factors of production: capital and labour. With just two factors of production the production function can be represented by a 3-dimensional graph. | |||

Tho most prominent production function for creating such a graph is the [[Cobb-Douglas production function]]: Y = A × C<sup>a</sup> × L<sup>b</sup>, where Y stands for yield, C for capital, L for labour, and A, a and b are constants | Tho most prominent production function for creating such a graph is the [[Cobb-Douglas production function]]: Y = A × C<sup>a</sup> × L<sup>b</sup>, where Y stands for yield, C for capital, L for labour, and A, a and b are constants that can be interpreted as A for technology level and a and b for the [[production elasticity|production elasticities]] of the factors. | ||

The classical concept is represented by the fact that combining the factors results in a square product so that a even proportion between the factors results in higher production output. | The classical concept is represented by the fact that combining the factors results in a square product so that a even proportion between the factors results in higher production output. | ||

The neoclassical concept is represented by the fact that each factor has diminishing returns as long as a < 1 and b < 1. Note that the combined input of both factors only results in diminishing returns as long as a + b < 1. If both factors independently have decreasing returns to scale (a < 1,b < 1), their combination might still lead to increasing returns to scale (a + b > 1). | The neoclassical concept is represented by the fact that each factor has diminishing returns as long as a < 1 and b < 1. Note that the combined input of both factors only results in diminishing returns as long as a + b < 1. If both factors independently have decreasing returns to scale (a < 1,b < 1), their combination might still lead to increasing returns to scale (a + b > 1). | ||

For an interactive demonstration of the Cobb-Douglas production function see: [http://www.fgn.unisg.ch/eurmacro/tutor/cobb-douglas-de.html] | For an interactive demonstration of the Cobb-Douglas production function see: [http://www.fgn.unisg.ch/eurmacro/tutor/cobb-douglas-de.html] | ||

Revision as of 05:02, 15 May 2008

Law of diminishing returns (Raw draft)

The law of diminishing returns (in this article referred to as LDR) is a concept in economic theory. It states that the output per input (productivity) declines if the input of a production factor is increased over a certain limit. Under the name law of diminishing returns actually exist two different concepts: one classical and one neoclassical. These concepts bear similarities but are based on different reasons.

The classical concept

In classical economics the LDR states the following: If you have at least two different production factors, the highest productivity is gained if an optimal proportion between these factors is kept. Any divergence from that proportion will result in lower productivity.

If one production factor is fixed, the proportion between the production factors will change with rising production i.e. rising input of the variable factor. According to the classical LDR this leads to a production function that has four phases with the following characteristics:

- Rising marginal productivity, rising average productivity.

- Diminishing marginal productivity, rising average productivity.

- Diminishing average productivity.

- Negative marginal productivity, i.e. an increase of the variable factor will result in a decrease of the overall product.

(Graph)

History

Historically the concept was first developed by Anne Robert Jacques Turgot. It was mainly related to agricultural production and the use of labour and fertilizer in relation to a fixed amount of soil.

Turgot, Observations sur le mémoire de M. de Saint-Péravy en faveur de l’impôt indirect, 1768. In: Turgot, Anne Robert Jacques (1727—1781), Oeuvres de Turgot, 1966, pp. 418 sqq., (421), Gallica, Bibliothèque nationale de France:

« La semence, jetée sur une terre naturellement fertile, mais sans aucune préparation, serait une avance presque entièrement perdue. Si on y joint un seul labour, le produit sera plus fort ; un second, un troisième labour pourront peut-être, non pas doubler et tripler, mais quadrupler et décupler le produit qui augmentera ainsi dans une proportion beaucoup plus grande que les avances n’accroissent, et cela, jusqu’à un certain point où le produit sera le plus grand possible, comparé aux avances. Passé ce point, si on augmente encore les avances, les produits augmenteront encore, mais moins, et toujours de moins en moins jusqu’à ce que, la fécondité de la nature étant épuisée et l’art n’y pouvant rien ajouter, un surcroît d’avances n’ajouterait absolument rien au produit. »

Possibly: Johann Heinrich von Thünen. (Ref. for Thünen?)

Critique

A production factor is only fixed if it is indivisible or if it is limited. Therefore it is generally possible to produce with an optimal proportion of factors and to use any available excess portion of one factor in a different area. Thus the classical LDR is closer related to business studies than to economics or political economy.

(Ref?)

The neoclassical concept

In neoclassical economics the LDR signifies that an increasing input of any production factor will result in diminishing marginal productivity. This leads to a production function with the following characteristics:

- Zero input of a production factor results in zero output i.e. the graph starts at the origin.

- Marginal productivity is highest with the lowest possible input, i.e. the point closest to an input of zero.

- Marginal productivity decreases continuously.

History

The origins of the neoclassical production function i.e. the neoclassical LDR date back to the time of classical economics. Then the concept was used to describe the effect of an increase in wheat production where good soils were limited. To increase the production of wheat inferior soils would have to be used, which would deliver less wheat for the same amount of labour.

(Ref. to Ricardo, Malthus?)

Neoclassical economists extended the idea to the claim that any economically rational producer would use any production factor first for the most productive task, then for the next productive task, etc., and/or would use the best unit first, then the second best, etc. (Ref. to whom?) Thus the idea got applied to all production factors. This implies of course that there are different tasks with different productivities and/or units of different quality.

(Ref. <F/H, S. 55, Fn. 4> --> english equivalent?)

Implications

The neoclassical LDR is one cornerstone of the General Equilibrium Theory.

Critique

The LDR is based on at least one of the following necessary assumptions:

- The quality of the units of a factor differs and this is known to and controllable by the producer, so that she can chose the better units over inferior ones (classical argument/wheat production).

- There are different fields of application for the units of a factor, that have different productivity, so that the producer can chose productive uses over less productives.

(Ref ?)

Possibly: Aggregation problems, compare [1]

The general application of the neoclassical LDR rules out rising marginal productivity and is therefore contrary to the economies of scale. (Ref ?) Business studies do not rule out rising marginal productivity and therefore do not accept the general validity of the neoclassical LDR. (Ref.) According to a survey among business leaders, businesses do not calculate with falling marginal productivity. (Ref: Check: Eiteman/Guthrie 1952)

Combining both concepts

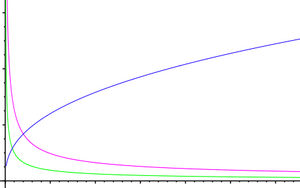

Neoclassical theory normally distinguishes between only two factors of production: capital and labour. With just two factors of production the production function can be represented by a 3-dimensional graph.

Tho most prominent production function for creating such a graph is the Cobb-Douglas production function: Y = A × Ca × Lb, where Y stands for yield, C for capital, L for labour, and A, a and b are constants that can be interpreted as A for technology level and a and b for the production elasticities of the factors.

The classical concept is represented by the fact that combining the factors results in a square product so that a even proportion between the factors results in higher production output.

The neoclassical concept is represented by the fact that each factor has diminishing returns as long as a < 1 and b < 1. Note that the combined input of both factors only results in diminishing returns as long as a + b < 1. If both factors independently have decreasing returns to scale (a < 1,b < 1), their combination might still lead to increasing returns to scale (a + b > 1).

For an interactive demonstration of the Cobb-Douglas production function see: [2]

Naming conventions

The naming convention for both concepts may be confusing. Turgot is considered physiocrat, not classical economist, and Ricardo is considered classical, not neoclassical economist. Yet the names of both concepts reflect the eras of their further development and refinement.