Great Depression, U.S.

The "Great Depression" in the U.S. was a decade of unemployment, low profits, low prices, high poverty and stagnant trade. It was part of the Great Depression that affected the entire world in the 1930s. Worst hit sectors were heavy industry, agriculture, mining and logging; least affected were white collar workers. The stock market crash of 1929 triggered the Great Depression in the United States which then spread to every continent. The depression ended in the late 1930s and caused major political changes, especially the New Deal that involved large scale federal relief programs, aid to agriculture, support for labor unions, and the formation of the New Deal coalition by Franklin Delano Roosevelt. The long-term memories affected the nation for decades as a consensus was reached that it would not be allowed to happen again and that the nation would have "Freedom from Fear."[1]

Causes

The Great Depression began with the plunge of prices on the New York Stock Exchange that began on Tuesday, October 29, 1929 and lasted for months. The search for causes is closely connected to the question of how to avoid a future depression, so the political and policy viewpoints of scholars are mixed into the analysis of historic events eight decades ago. Current theories may be broadly classified into two main points of view. First, there is orthodox classical economics, monetarist, Keynesian, Austrian Economics and neoclassical economic theory, which focuses on the macroeconomic effects of money supply, including production and consumption. Second, there are structural theories, including those of institutional economics, that point to underconsumption and over-investment (or "economic bubble"), or to malfeasance by bankers and industrialists.

There are multiple issues—what set off the first downturn in 1929, what were the structural weaknesses and specific events that turned it into a major depression, and how did the downturn spread from country to country.

In terms of the 1929 small downturn, historians emphasize structural factors and the stock market crash, while economists point to Britain's decision to return to the Gold Standard at pre-World War I parities at $4.86 per pound. [3]. All analysts give some role to the Wall Street Crash of 1929 as the immediate cause triggering the Depression, there are other, causes that explain the crisis. Herbert Hoover, for example, stressed that the vast economic cost of World War I weakened the ability of the world to respond to a major crisis.

Economists dispute how much weight to give the stock market crash of October 1929. According to Milton Friedman, "the stock market (crash) in 1929 played a role in the initial depression." It clearly changed sentiment about and expectations of the future, shifting the outlook from very positive to negative, with a dampening effect on investment and entrepreneurship. In the long run, the market did not recover; it began almost continuously to head downward until 1933, producing the greatest long-term market declines by any measure and erasing billions in assets.

Macroeconomists such as Ben Bernanke have revived the debt-deflation view of the Great Depression originated by Arthur Cecil Pigou and Irving Fisher. In the 1920s, in the U.S. the widespread use of the home mortgage and credit purchases of automobiles and furniture boosted spending but created consumer debt. People who were deeply in debt when a price deflation occurred were in serious trouble—even if they kept their jobs—and risked default. They drastically cut current spending to keep up time payments, thus lowering demand for new products. Furthermore the debts grew, because prices and incomes fell 20-50%, but the debts remained at the same dollar amount. With future profits looking poor, capital investment slowed or completely ceased. In the face of bad loans and worsening future prospects, banks became more conservative in lending money. They built up their capital reserves, which intensified the deflationary pressures. The vicious cycle developed and the downward spiral accelerated. This kind of self-aggravating process may have turned a 1930 recession into a 1933 depression.

Many economists at the time argued that the sharp decline in international trade after 1930 helped to worsen the depression, especially for countries dependent on foreign trade. Most historians and economists blamed the American Smoot-Hawley Tariff Act of 1930 for worsening the depression by reducing international trade and causing retaliation. However, foreign trade was a small part of overall economic activity in the United States; it was a much larger factor in most other countries. [1] The average ad valorem rate of duties on dutiable imports for 1921-1925 was 25.9% but under the new tariff it jumped to 50% in 1931-1935.

In dollar terms, American exports declined from about $5.2 billion in 1929 to $1.7 billion in 1933; but prices also fell, so the physical volume of exports only fell in half. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber. According to this theory, the collapse of farm exports caused many American farmers to default on their loans leading to the bank runs on small rural banks that characterized the early years of the Great Depression

Monetarists, including Milton Friedman and Ben Bernanke, stress the failure of the American Federal Reserve System to take action as the money supply fell by one-third from 1930 to 1931. With significantly less money to go around, businessmen could not get new loans and could not even get their old loans renewed, forcing many to stop investing. This interpretation says the Federal Reserve might have been able to slow the depression but failed to do so. The Fed was not controlled by President Hoover or the U.S. Treasury; it was primarily controlled by member banks and businessmen and it was to these groups that the Fed listened most attentively regarding policies to follow.

Milton Friedman argues in A Monetary History of the United States (1963), that the downward turn in the economy starting with the stock market crash would have been just another recession. In general, he states the problem was that some bank failures produced widespread runs on banks. He claims that if the Federal Reserve had acted by providing emergency lending to these key banks or simply bought government bonds on the open market to provide liquidity and increase the quantity of money after the key banks fell, all the rest of the banks that fell after the very large and public ones did would not have, the money supply would not have fallen to the extent it did, and would not have fallen at the speed it did. The banks that failed were nearly all small local operations in neighborhoods or small towns. Before 1933 there were no major bank failures in the major cities.

The revolutionary left saw the Great Depression as the beginning of capitalism's final collapse. The idea mobilized the far left for action, but they failed to take power in any major country in the 1929-32 period.

Roosevelt primarily blamed the excesses of big business for causing an unstable bubble-like economy. He claimed that the problem was that business had too much power, and the New Deal was intended to remedy that by empowering labor unions and farmers (which it did) and by raising taxes on corporate profits. The New Dealers tried to raise taxes and failed. Regulation of the economy was a favorite remedy. Most of the New Deal regulations were abolished or scaled back in 1975-1985 in a bipartisan wave of deregulation. However the Securities and Exchange Commission which regulates Wall Street, won widespread support and continues to this day.

The British economist John Maynard Keynes argued that the lower aggregate expenditures in the economy contributed to a multiple decline in income, well below full employment. In this situation, the economy may reach perfect balance, but at a cost of high unemployment. Keynesian economists were increasingly calling for government to take up the slack by increasing government spending.

Initial Reaction

Treasury Secretary Andrew Mellon advised President Hoover that a shock treatment would be the best response: "Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. . . . [That] will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people."[4]. Hoover rejected the advice, and made Mellon an ambassador.

Hoover did not believe that the government should directly aid the people, but insisted instead on "voluntary cooperation" between business and government. Hoover believed that the stock market crash was a regular hiccup in the capitalistic cycle, and that it need not affect the greater economy. Hoover asked large business leaders to voluntarily "take a hit" for the greater good of the nation. Business leaders agreed initially, but in practice no business wanted to put their neck out and risk complete failure for the good of the economy. Hoover also promoted a scheme (not enacted) designed to prevent bank runs. Once again, business agreed that it was a good idea, but they were incapable of coordinating such an organization on their own. Hoover's "voluntary cooperation" failed, but all these failed government interventions only proved that more government interventions were needed.

New Deal

From 1933 onward, Roosevelt argued a restructuring of the economy would be needed to prevent another or avoid prolonging the current depression. New Deal programs sought to stimulate demand and provide work and relief for the impoverished through increased government spending, by:

- Reforming the financial system, especially the banks and Wall Street. The Securities Act of 1933 comprehensively regulated the securities industry. This was followed by the Securities Exchange Act of 1934 which created the Securities and Exchange Commission. (The key provisions of both Acts are still in force as of 2007). Federal insurance of bank deposits was provided by the FDIC (still operating as of 2007), and the Glass-Steagal Act (which remained in effect for 50 years and has now been repealed.).

- Instituting regulations which ended what was called "cut-throat competition," which kept forcing down prices and profits for everyone. (The NRA, which opertated 1933-35).

- Setting minimum prices and wages and competitive conditions in all industries. (the NRA)

- Encouraging unions that would raise wages, to increase the purchasing power of the working class. (Wagner Act, 1935)

- Cutting farm production so as to raise prices and make it possible to earn a living in farming (done by the AAA and successor farm programs).

The most controversial aspect of the New Deal agencies was the National Recovery Administration (NRA). It lasted less than two years (1933-35) and ordered:

- businesses to work with government to set price codes;

- the NRA board to set labor codes and standards.

These reforms (together with relief and recover measures) are called by historians the "First New Deal." It was centered around the use of an alphabet soup of agencies set up in 1933 and 1934, along with the use of previous agencies such as the Reconstruction Finance Corporation, to regulate and stimulate the economy. By 1935, the "Second New Deal" added social security, a national relief agency (the WPA) and, through the National Labor Relations Board, a strong stimulus to the growth of labor unions. Unemployment fell by two-thirds in Roosevelt's first term (from 25% to 9%, 1933 to 1937), but then remained stubbornly high until 1942.

In 1929, federal expenditures constituted only 3% of the GDP. Between 1933 and 1939, they tripled, funded primarily by a growth in the national debt. The debt as proportion of GNP rose under Hoover from 20% to 40%. Roosevelt kept it at 40% until the war began, when it soared to 128%. After the Recession of 1937, conservatives were able to form a bipartisan Conservative coalition to stop further expansion of the New Deal and, by 1943, had abolished all of the relief programs.

Recession of 1937

By 1936 all the main economic indicators had regained the levels of the late 1920s, except for unemployment, which remained stubbornly high. In 1937, the American economy took an unexpected nosedive, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938. The Roosevelt administration reacted by launching a rhetorical campaign against monopoly power, which was cast as the cause of the depression, and appointing Thurman Arnold to act; Arnold was not effective and the attack ended once World War II began and corporate energies had to be directed to winning the war. By 1939 the effects of the 1937-recession had disappeared.

Employment in private sector factories recovered to the level of the late 1920s by 1937 (see chart 2), but did not grow much bigger until the war came and manufacturing employment leaped from 11 million in 1940 to 18 million in 1943.

The administration's other response to the 1937 deepening of the Great Depression had more tangible results. Ignoring the pleas of the Treasury Department, Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938, an effort to increase mass purchasing power. Business-oriented observers explained the recession and recovery in very different terms from the Keynesians. They argued the New Deal had been very hostile to business expansion in 1935–37, had encouraged massive strikes which fiscal stimulus required to end the downturn of the Depression was, and it led, at the time, to fears that as soon as America demobilized, it would return to Depression conditions and industrial output would fall to its pre-war levels. The incorrect Keynesian prediction of a new depression would start after the war failed to take account of pent-up consumer demand as a result of the Depression and World War.

Ending of the depression

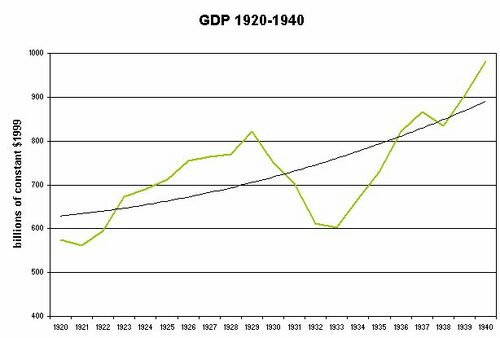

As the GDP data in Chart 1 shows, the depression of 1929 effectively ended in 1937, except for persistent high unemployment. Unemployment declined after 1940 for a variety of interlocking reasons. The government began heavy military spending in 1940, and started drafting millions of young men that year; by 1945 16 million had entered service. But that was not enough to absorb all the unemployed. During the war the government subsidized wages through cost-plus contracts. That is a business was paid in full for its costs, with a percentage profit margin added on. That meant the more wages paid the better, as the government would cover them plus a percentage. In 1941-43 many factories took in unskilled workers and trained them (at government expense); little training done in the 1930s and most factories refused to hire the unskilled, the inexperienced, or men "too old" (over 45). The military itself was a massive training program in technology for most soldiers and sailors. Structural barriers were lowered during the war, especially informal policies about hiring women, minorities, and workers over 45 or under 18. See FEPC. Strikes largely ended as unions pushed their members to work harder. Tens of thousands of new factories and shipyards were built, with bus service and nursery care for children making them more accessible. Wages soared for workers, making it quite expensive to sit at home. The combination of all these factors drove unemployment to below 2% in 1943, as sound trucks roamed the streets blaring announcements that the factories were hiring, please apply. [5]

Bibliography

- Bakke E. Wright. The Unemployed Worker: A Study of the Task of Making a Living without a Job. (1940).

- Beito David. Taxpayers in Revolt (1989)

- Bernanke, Ben S. "The Macroeconomics of the Great Depression: A Comparative Approach," Journal of Money, Credit & Banking, Vol. 27, 1995 online edition

- Bernstein, Irving. Turbulent Years: A History of the American Worker, 1933-1941 (1970), the most thorough labor history

- Bernstein, Michael A. The Great Depression: Delayed Recovery and Economic Change in America, 1929-1939 (1989)

- Best, Gary Dean. The Nickel and Dime Decade: American Popular Culture during the 1930s. (1993) online edition

- Best, Gary Dean. Pride, Prejudice, and Politics: Roosevelt Versus Recovery, 1933-1938 (1991), conservative critique

- Blumberg Barbara. The New Deal and the Unemployed: The View from New York City (1977).

- Bordo, Michael D., Claudia Goldin, and Eugene N. White , eds., The Defining Moment: The Great Depression and the American Economy in the Twentieth Century (1998). Advanced economic history.

- Bremer William W. "Along the American Way: The New Deal's Work Relief Programs for the Unemployed." Journal of American History 62 (December 1975): 636-652 online in JSTOR

- Cantril, Hadley and Mildred Strunk, eds. Public Opinion, 1935-1946 (1951), massive compilation of many public opinion polls online edition

- Chandler, Lester. America's Greatest Depression (1970). overview by economic historian.

- Fisher, Irving. "The Debt-Deflation Theory of Great Depressions," Econometrica, Vol. 1, No. 4 (Oct., 1933), pp. 337-357 in JSTOR

- Friedman, Milton and Anna J. Schwartz, A Monetary History of the United States, 1867-1960 (1963), classic monetarist explanation; highly statistical; partly reprinted as The Great Contraction. excerpt and text search

- Grant, Michael Johnston. Down and Out on the Family Farm: Rural Rehabilitation in the Great Plains, 1929-1945 (2002)

- Hapke, Laura. Daughters of the Great Depression: Women, Work, and Fiction in the American 1930s (1997) excerpt and text search

- Himmelberg; Robert F. ed The Great Depression and the New Deal (2001), short overview

- Howard, Donald S. The WPA and Federal Relief Policy (1943) online edition

- Jensen, Richard J. "The Causes and Cures of Unemployment in the Great Depression," Journal of Interdisciplinary History 19 (1989) 553-83. at JSTOR

- Kennedy, David. Freedom from Fear: The American People in Depression and War, 1929-1945 (1999), wide-ranging survey by leading scholar; online edition

- Klein, Maury. Rainbow's End: The Crash of 1929 (2001) by economic historian excerpt and text search

- Kubik, Paul J. "Federal Reserve Policy during the Great Depression: The Impact of Interwar Attitudes regarding Consumption and Consumer Credit" Journal of Economic Issues, Vol. 30, 1996

- Lowitt, Richard and Beardsley Maurice, eds. One Third of a Nation: Lorena Hickock Reports on the Great Depression (1981)

- Lynd Robert S., and Helen M. Lynd. Middletown in Transition. 1937. sociological study of Muncie, Indiana

- McElvaine Robert S. The Great Depression 2nd ed (1993) social history

- Mitchell, Broadus. Depression Decade: From New Era through New Deal, 1929-1941 (1964), overview of economic history online edition

- Parker, Randall E. Reflections on the Great Depression (2002) interviews with 11 leading economists

- Roose, Kenneth D. "The Recession of 1937-38" Journal of Political Economy, Vol. 56, No. 3 (Jun., 1948) , pp. 239-248 online in JSTOR

- Romasco Albert U. "Hoover-Roosevelt and the Great Depression: A Historiographic Inquiry into a Perennial Comparison." In John Braeman, Robert H. Bremner and David Brody, eds. The New Deal: The National Level (1973) v 1 pp 3-26.

- Romer, Christina D. "The Nation in Depression," The Journal of Economic Perspectives, Vol. 7, No. 2. (Spring, 1993), pp. 19-39. major survey by leading economist, with comparisons to other nations in JSTOR

- Romer, Christina D. "What Ended the Great Depression?" The Journal of Economic History, Vol. 52, No. 4 (Dec., 1992), pp. 757-784 in JSTOR

- Romer, Christina D. "The Great Crash and the Onset of the Great Depression," The Quarterly Journal of Economics, Vol. 105, No. 3 (Aug., 1990), pp. 597-624 in JSTOR

- Rosen, Elliot A. Roosevelt, the Great Depression, and the Economics of Recovery (2005) argues productivity gains were more responsible for long-term recovery than New Deal

- Rothbard, Murray N. America's Great Depression (1963), by leading libertarian economist

- Saloutos, Theodore. The American Farmer and the New Deal (1982).

- Shlaes, Amity. The Forgotten Man: A New History of the Great Depression (2007), 480pp, popular

- Singleton, Jeff. The American Dole: Unemployment Relief and the Welfare State in the Great Depression (2000) excerpt and text search

- Sitkoff, Harvard. A New Deal for Blacks (1978).

- Smiley, Gene. Rethinking the Great Depression (2002), conservative economist blames Federal Reserve and gold standard excerpt and text search

- Smith, Jason Scott. Building New Deal Liberalism: The Political Economy of Public Works, 1933-1956 (2005).

- Sternsher, Bernard ed., Hitting Home: The Great Depression in Town and Country (1970), readings on local history

- Szostak, Rick. Technological Innovation and the Great Depression (1995)

- Temin; Peter. Did Monetary Forces Cause the Great Depression (1976)

- Tindall George B. The Emergence of the New South, 1915-1945 (1967). History of entire region by leading scholar

- Trout Charles H. Boston, the Great Depression, and the New Deal (1977)

- Warren, Harris Gaylord. Herbert Hoover and the Great Depression (1959).

- Watkins, T. H. The Great Depression: America in the 1930s. (1993). excerpt and text search

- Wheeler, Mark, ed. The Economics of the Great Depression (1998)

- Eugene N. White, "The Stock Market Boom and Crash of 1929 Revisited," The Journal of Economic Perspectives Vol. 4, No. 2 (Spring, 1990), pp. 67-83, evaluates different theories online in JSTOR

- Wicker, Elmus. The Banking Panics of the Great Depression 1996 online review

- Wecter, Dixon. The Age of the Great Depression, 1929-1941. (1948). social history